by Ursula Curiosa, F.K.A. Lindsey Krantz

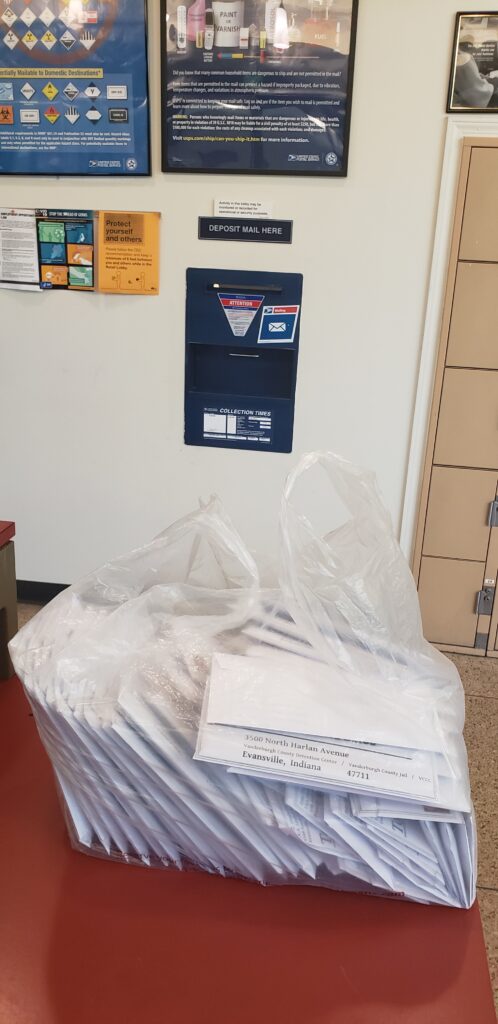

As I write this note to you all, my beloved Guildies, dozens of envelopes of flaming hot printed material make their ways through Evansville, IN, after being edited, printed, signed, sealed, stamped, then oh-so-hopefully dropped into the mail for delivery at the Vanderburgh County Jail: a concrete camp where those with a monopoly on the legitimate use of violence concentrate their efforts on repressing about 650 people daily.

On March 29, a group of volunteers I belong to mailed tax-packet letters containing a dignity-affirming cover letter, three copies of the IRS-1040 personal tax return form, where-to-file addresses for people filing from Indiana, a worksheet torn from the 1040’s instructions about how to figure Line #30 (Recovery Rebate Credit: “stimulus money”), and an Evansville-specific resource guide with a 2021 calendar printed on the back.

When we had this idea to assist people in claiming their stimulus money, I checked into eligibility requirements (there was nothing mentioned about being incarcerated). Good to go, right? Not exactly: Former jailhouse lawyer Mr. Terry Lindsey mailed me a circular from the Indiana Department of Correction, which notified him about Scholl et al. v. Mnuchin et al (U.S. District Court, N.D. California, Case No. 20-cv-05309-PJH). The case delighted me: I write this note ito share the good news, as Mr. Lindsey did with me.

To get these payments kicked loose for prisoners, the Equal Justice Society and Lieff Cabraser Heimann & Bernstein, LLP, represented Plaintiffs Colin Scholl and Lisa Strawn on behalf of themselves and all others “who have been incarcerated in the United States at any time from March 27, 2020 to the present.” Congress had an opportunity to exclude prisoners from receiving stimulus payments, but did not do so, therefore Treasury Secretary Mnuchin, et al.’s position of withholding payments from prisoners solely based on incarcerated status was unacceptable.

The angle here is personal, political, and mathematical. For example, the return on investment could be 179,900%, considering a $1,800 payment and $1 to cover postage and materials. This prisoner solidarity crew’s members have first-person and vicarious experiences with incarceration and police terrorism, which coalesce with our willingness, ideas, and abilities to righteously love and rage through stuffing these hundreds of envelopes.

We send this mail because we intimately know that often official forms are difficult or impossible for incarcerated people to obtain. At first, people received our tax-packet mail, then cops began to mark our mail as “CONTRABAND: Reason (other): tax forms.” A few also got marked down as “mass mailing.” After a few more attempts of trifling resistance, Vanderburgh County Sheriff David Wedding and his Lt. K. Blessinger directed that the packets get into their facility.

I am white, as are most of the crew and most of the people in this geographic region. This jail mail effort is not color-blind—it is anti-racist. By simply addressing everyone at the jail without regard to state-assigned “race,” more letters go to Black people than to whites as compared to their respective portions in the county’s population, due to racism in methods used to concentrate prisoners. Sometimes, as in this rare example, seemingly color-blind policies can come to a just fruition.

Incarcerated people can file their tax returns at Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0003, or at the normal filers’ address for their state of residence. For people with internet access: go to caresactprisoncase.org to find more information.

In sum, I encourage Guildies to drop an elbow on this effort to get stimulus payments to incarcerated people. Tax Day this year (May 17) was not the final day to claim the Recovery Rebate Credit, regardless of being locked up, since 2020 tax returns can be filed up to three years back. Do as much or little as you care to do, but please do something, such as simply sharing a few 1040’s and the good news of Scholl et al. v. Mnuchin et al. with those who are locked up.

And a special note to Guildie Jailhouse Lawyers: I am a Legal Worker on the outside and I treasure you all as part of the Guild. I acknowledge your closeness to the boot heel of the white supremacist straight-armed monster which I call Amerikkka. All of the NLG is “Guildy As Charged” and I offer our Jailhouse Lawyers my profound love and boiling rage.